By Simon Chadwick

Managing Partner

simon@consultcambiar.com

Cambiar Consulting

Raleigh, North Carolina

By Kahren Kersten

Senior Consultant

kahren@consultcambiar.com

Cambiar Consulting

Raleigh, North Carolina

IN AN AGE OF TECHNOLOGY that a few years ago was the stuff of science fiction, the role of the market researcher is changing dramatically.

A role that was built on a foundation of processes, mechanics, and methodologies is now being subsumed by artificial intelligence (AI) that is not only capable of replicating all of these but can also enable entirely new approaches and capabilities. In the realm of qualitative research, for example, not only can AI take care of basic analysis, but it can do so in the context of thousands of qualitative interviews that it itself conducts via intelligent bots and avatars—so-called “qual-at-scale.”

Even beyond this, there is now great anticipation and excitement in many large organizations at the prospect of the mountains of unstructured data they possess being analyzed by AI and producing insights that were hitherto unknown.

Where does this leave the qualitative researcher of today?

From Empathy to Strategy

Much of the discussion surrounding this question has rightly focused on the need to understand the often-irrational complexity of human emotions that are difficult for a machine to read or decode. While behavioral science is increasingly being incorporated into AI models, the argument is this: it still takes a human to gauge another human’s underlying emotional and nonrational states. In a live focus group or a face-to-face IDI, emotions and truths are still decoded by the most minute facial or bodily expressions, and, as Rob Volpe has so eloquently argued in his excellent book, Tell Me More About That, it takes empathy to do this at the level required to unleash real insight.

We would argue, however, that the role of the researcher must now go beyond decoding emotions; our future is already being revealed by the degree to which we are being urged to act as strategic partners and consultants. Survival and growth in this new environment will depend less on methods alone and more on taking on roles that AI cannot easily replicate. Qualitative practitioners have an opportunity to claim a seat at the strategy table by building on their unique skills, offering facilitation, findings integration, and activation services, and by “translating” the meaning of insights for different teams within a company. To understand how we got here, we begin with a look at the shifts transforming in-house insight teams, then we’ll widen the lens to consider what these dynamics mean for qualitative practitioners, from independent consultants to research firms of any size.

We would argue, however, that the role of the researcher must now go beyond decoding emotions; our future is already being revealed by the degree to which we are being urged to act as strategic partners and consultants. Survival and growth in this new environment will depend less on methods alone and more on taking on roles that AI cannot easily replicate. Qualitative practitioners have an opportunity to claim a seat at the strategy table by building on their unique skills, offering facilitation, findings integration, and activation services, and by “translating” the meaning of insights for different teams within a company. To understand how we got here, we begin with a look at the shifts transforming in-house insight teams, then we’ll widen the lens to consider what these dynamics mean for qualitative practitioners, from independent consultants to research firms of any size.

From recent research¹ we conducted for the Global Research Business Network (GRBN), the Insights Association, and the UK’s Market Research Society, we discovered that some in-house consumer insights (CI) functions have earned the right to be considered strategic partners to their stakeholders. These CI functions all share a few common characteristics:

- They are increasingly integrating with a wide variety of data functions within their organizations—some structurally by amalgamating positions from different data teams, and others merely in the way they work together. This reflects an increasing realization that insights today do not arise out of singular studies or ways of collecting data but from the synthesis of a variety of data sources.

- The skills for which these teams recruit and train go way beyond methodology and now focus on consulting, activation of insights, and leadership. This recognizes that if you are going to be a strategic partner, you will need to be actively involved in decision-making and not merely providing information or even recommendations.

- These teams that have become strategic partners to their stakeholders constantly and consistently communicate the knowledge they have accumulated over time, through different projects, as well as information that conclusively proves their value to the business. Very often, this includes measuring and communicating the return on investment (ROI) that consumer insights provide. In this way, they become an asset on the balance sheet, not a cost on the profit and loss statement.

As we uncovered these traits, we also started to realize that there exists today an interesting dichotomy in the way in which internal CI teams operate, differentiating increasingly between routine research jobs and premium strategic work. Over the last two years, industry data² has suggested that the level of insourcing in major corporations has reached 50 percent of all projects undertaken—a big jump from less than 20 percent 10 years ago. This does not extend to all industries (for example, very little is insourced in pharmaceuticals), but it is an overall average that speaks to the extent that “ResTech” (Research Technology) has taken a permanent place in how we conduct research. With ResTech’s promises of easier “DIY” access to insights and faster project execution, it has paved the way for in-house teams to bypass external data specialists.

At the same time, companies are outsourcing more and more of their top-end strategic work—and they are not outsourcing it to generalist market research companies. Instead, they are choosing to work with specialized firms that offer research of outstanding quality and overlay that research with strategic consulting, activation capabilities, and design and communication prowess. We call these Research ++ firms. Interestingly, data from the Insights Association³ suggests that research companies like this grow faster than their peers and are significantly more profitable.

Qualitative Practitioners as Connectors

What, you ask, does this have to do with qualitative research practitioners? This question may especially be top of mind for qualitative researchers who are independent contractors and may not be in the strategic conversations that ensue from the production of insights. However, others may also benefit from asking themselves: how can and should any qualitative practitioner respond to this trend?

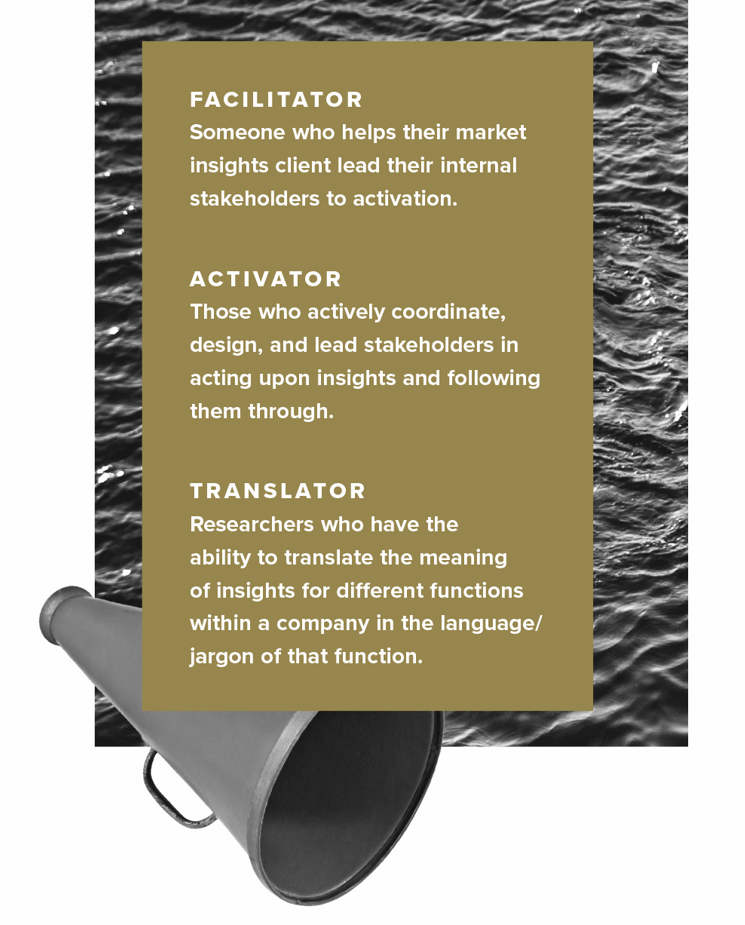

Beyond their ability to bring empathetically derived human insights to the table, qualitative practitioners are blessed with the talent of facilitation—precisely the talent that helps clients lead their stakeholders to insight activation. Qualitative practitioners can be activators by coordinating, designing, and leading sessions to help stakeholders act upon insights and following them through, thus promoting collaboration between stakeholders and also between different data silos within the client organization. One senior corporate client that we talked to described this talent of qualitative practitioners as being “translators.” They can act as the connectors between all the parties at the table who activate insights and make decisions. They can help translate “insights speak” into “business speak,” consumer language into marketing language.

Notably, to do this, it is also going to take category expertise, knowledge of the business, and the ability to provide interdisciplinary interpretation of the data. While much of this may be achieved by a more traditional model with a consultant contracted to work directly with the end-client, there is also an increasing normalization of (and need for) small businesses to develop partnerships that amplify their strategic capabilities as a project team.

Being a translator individually, or as a small-business partnership, is a tremendous gift as it enables collaboration between silos and at different levels. Even if you are an independent contractor, your ability to foster collaboration through translation is something that you can build into all your proposals. Activation-via-translation services should always be included in what you offer.

At the same time, contractors of all sizes (from individuals to larger qualitative firms) should think about what activation services entail. It’s not just about facilitating an activation session (although this is hugely valuable), it’s also about how you help your client synthesize your findings with those they already have, layer on multidimensional interpretation, and then report the outcome in compelling ways that will inspire action.

There are qualitative companies in the market today that are stunningly good in how they report insights, particularly through the medium of video. Think of this and other media not only as tools that can aid in activation but also as materials that your client can use internally to promulgate knowledge throughout their organization and provide proof of their value to the business as a whole.

In our conversations with senior client-side CI executives (and there have been many), one thing stands out: they may view a handful of preferred research suppliers as their strategic partners, but there is always one person or firm that they value above all others. That person or firm is their preferred qualitative supplier. Why? Because they trust them and they have a close relationship with them. It is this relationship that will enable you as a qualitative practitioner to offer yourself up as a strategic partner, an activation moderator, a proof of value communicator, and, above all, a translator.

Knowing that many brands today are facing significant budget constraints, relying more on less-experienced staff, and are under pressure to demonstrate value, this grounds us in what these research buyers will prioritize when they choose their supplier partners. These brand-side researchers most value expert support, innovative methods, and cost-effective insights. Independent consultants, with lower overhead and flexibility to develop AI skills, can offer valuable guidance on when to use AI and when human-driven qualitative research is needed. They can integrate AI into their approaches and partner with other experts to bring even more value to the table.

One final thought: In the past, researchers have tended to price their work based on the amount of labor a particular project would consume. Five focus groups? Twenty IDIs with a difficult-to-recruit population? Add up the hours and there’s your price. No longer! In the age of AI, labor hours will no longer count. What counts now is the value you bring to the decision to be made and to your client partner. Shifting to this paradigm won’t be easy, but it will be necessary if we are all to be judged on our output, not our input..

References

References

- Cambiar Consulting. Measuring the Business Impact of Insights: 2023 GRBN Business Maturity Study. Conducted on behalf of the Global Research Business Network, Insights Association, and the Market Research Society.

- ESOMAR. Global Buyers of Insights 2025.

- Insights Association. Annual State of U.S. Insights & Analytics Report.

Be the first to comment